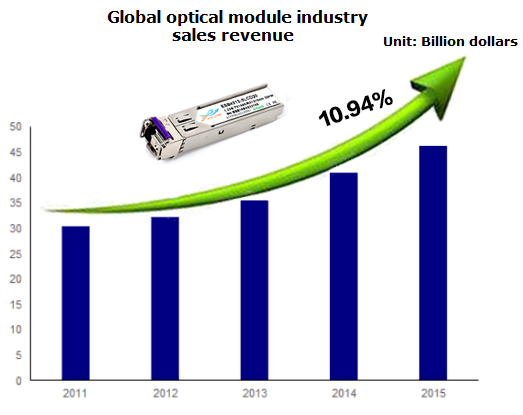

In the more than 20 years of optical module technology development, many companies at home and abroad have participated in the development and production of optical modules, and there are many companies producing optical modules internationally, such as JDSU, Finisar, Oclaro, Avago, Opnex, etc. More than 20 manufacturers of optical modules, such as Zhengyuan Photonics, Hisense Optoelectronics, WTD, etc. Moreover, the construction of 5G in China has promoted the continuous development of optical module technology, and the team of optical module manufacturers is also expanding. According to statistics, the optical module market has an average annual growth rate of about 10% from 2010 to 2017.

According to forecasts, the demand for optical modules in data centers will exceed 50 million in the next few years, which is a huge opportunity for transceiver manufacturers. The large-scale deployment and application of 5G networks will promote the rise in demand for high-speed optical modules, which in turn will drive the development of related industries. Optical modules are mainly used in 5G base stations, passive optical networks (PON) and data centers. In 5G network deployment, some analysts believe that the number of macro base stations in the 5G era is about 1.5 to 2 times that of 4G, while a conservative estimate is that micro base stations are about twice as many as macro base stations. At present, the number of 4G base stations deployed by China’s three major operators has reached 4.45 million, which means that the construction demand for 5G macro base stations will be 6.68 million to 9 million, and the demand for 5G micro base stations will be about 13.5 million to 18 million. From this, it is predicted that the demand for fronthaul optical modules of 5G macro base stations is about 40 million to 55 million, and the demand for optical modules of 5G micro base stations will exceed 30 million. According to preliminary estimates, the market size of various 5G optical modules in the Chinese market is about US$6.5 billion, while the global market is about US$12 billion. In terms of PON, operators are actively promoting the “Double Thousand Strategy”, which means that the FTTH rate will be directly increased from the current 100Mb/s to 1000Mb/s, thereby promoting the demand for 10GPON high-speed optical modules. In terms of data centers, the large-scale deployment of 5G networks will accelerate the development of 5G applications, thereby increasing the demand for data volume, which will drive the industry to upgrade existing data centers and build new data centers. According to the forecast of Moor Insights & Strategy, a foreign research institute, by 2025, the infrastructure investment for 5G will exceed 326 billion USD, 56% of which will go to data centers. Between 2019 and 2023, the compound annual growth rate of the global data center market will exceed 17%. The raw materials of optical modules mainly include integrated circuit chips and structural parts, optical chips and components, etc. Among them, optical chips and components are the core raw materials, and their cost accounts for more than 50% of the total cost, and the higher the high-end and higher-speed optical modules, the higher the cost of optical chips. At present, such core components are still monopolized by developed countries.

There are many supply channels for basic raw materials such as circuit boards. In the 5G era, 4G passive antennas have been improved into active antennas, which has led to an increase in the use of baseband chips, filters and power amplifiers in radio frequency modules in the industry chain. The Minsheng Bank Research Institute predicts that the demand for optical modules in the 5G era will be 1.6-4.2 times that of 4G, and the demand for RF front-end is 7-8 times that of 4G. At present, the field of optical modules is still dominated by foreign manufacturers. The localization rate of high-end optical communication chips is less than 10%. Qualcomm has always maintained a market share of more than 50% in the baseband chip market. As an emerging optical module manufacturer, QSFPTEK produces SFP+, QSFP+ optical modules, and has a certain share in the Southeast Asian market.